Those not watching our planet becoming a mess of conflict may be too embroiled in their own concerns to see it happening. Some people, not just social scientists, journalists, and the like, make it their personal concern to see how the world and its leaders are managing their business. If someone has been observing this conflict over time, it is clear we are in a period of great tension. It is not yet civil war, but threats are made. We fight over the same reality, the same world, because from our own eyes it is somehow different from one person to the next.

Because there is not a consistent honest narrative across media platforms, which are ideologically fragmented, those differences lead us to fight amongst each other, rather than observe the common threat, which is unfettered power over the people.

Some argue that it is in fact the consolidation of corporate media, from hundreds of local and regional media companies, and broadcasters, to just a handful. This is a valid argument, however complicated by the new media ecosystem evolving out of podcasting. I think we would be remiss not to analyze the phenomenon of literacy and self-liberation from intellectual oppression.

The United States has produced more citizens with college degrees — sometimes multiple degrees — than ever before, by an incredible margin. The gender gap narrowed and crossed over in 2015 so that women are now better educated than men. This is an incredible reversal since 1940, when women also first entered the work force.

The percentage of Americans with four years of college education or more has improved from 5% to 35%, which doesn’t sound so impressive until I point out this represents a 700% increase since 1940 — we had already become a modernized nation with world leading literacy rates and universities across 48 states.

Without getting into the weeds, we also know that literacy rates have improved globally, while ethnic minorities and immigrants enter higher education at increasing rates. Speaking as a White Male, I am not threatened because I believe in a diverse world where gender roles and ethnic cultures are celebrated in a political-economic system that cherishes everyone’s inherent contribution. That is not what we have now.

The dominant class demands specific social attitudes and economic adherences or you and your business will not be able to survive. Millions of Americans reflect the feeling that they have to compartmentalize their real opinions and feelings from one relationship to the next. I believe this is natural, to some extent. You should not be intimate with your boss, or submissive to your spouse. What I am concerned about is people conforming their behavior to accommodate those that hold power over them, be it their boss or their spouse. We should all be nice to each other, polite, and considerate, out of genuine concern, not fear of repercussion. Civility is disappearing as a symptom of what I am analyzing here.

I watch the privileged white liberal class going around calling their opponents racist, sexist, homophobic, transphobic, and xenophobic, while the number of white males in positions of power, their educational advantage down to their share of labor jobs, all declining.

Let me tell you what I am: I am arachnophobic, and I’ve been one step ahead of the spider my entire life. The spider is the global elite, friends, and their webs are in the media, the education system, politics, and they drive the economics.

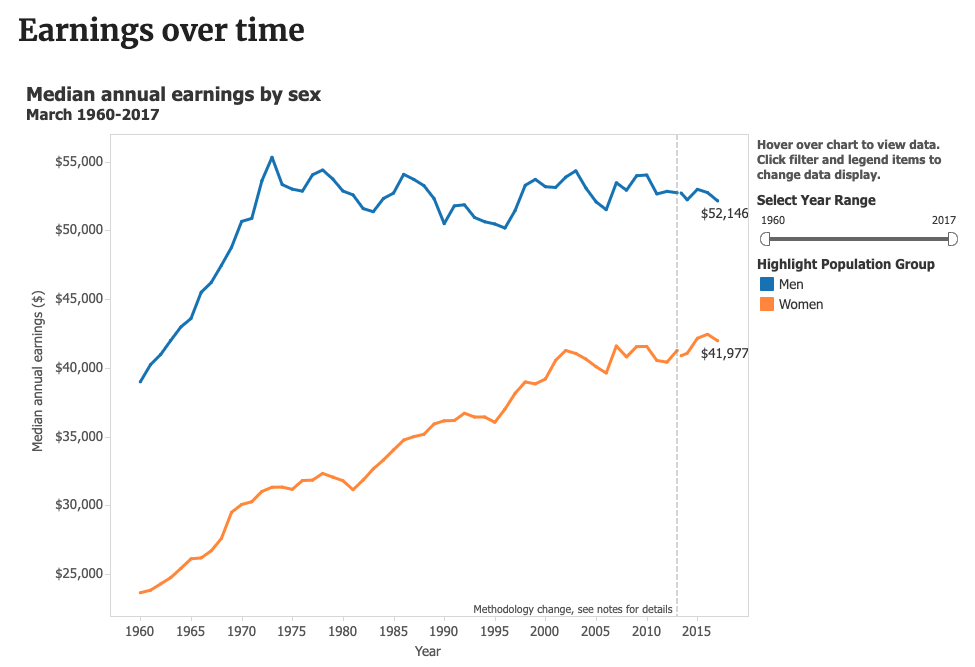

When your identity is rooted in economic class, you are together with the 90% of Americans. Only the upper 10% have seen any kind of wage increase since 1970, while the 1% enjoyed an incredible period of wealth accumulation over the same time. The average CEO was paid about ten times wealthier than their lowest paid employee in 1950, whereas today they factor in the hundreds, and that is on average. If you compare Warren Buffet to his janitors, or Jeff Bezos to his fulfillment clerks, we’re looking at an easy thousandfold disparity. Everybody is marginalized in today’s economics.

Nobody wants to study the decline of the American white male out of fear of repercussions from the dominant liberal class. I could be labeled alt-right just for observing this even though my personal ideology puts all genders and ethnicities into an anarchist-libertarian cooperative society that would make it impossible for any single identity to become dominant, because power is not held in leaders, rather, in cooperative bodies.

I do not get to live in that world, I am required to abide by the neoliberal capitalist framework in America regardless of the cognitive dissonance this puts me through, regardless of the mediocrity of my superiors, and the failures of their systems.

Why is the steady decline of workforce participation among white males totally ignored in the narrative of white privilege? Because narratives aren’t facts. Facts educate the mind. Narratives entertain and condition the mind. You are better controlled by narrative. They give us the facts, but very few people study them. I suggest you study them.

Women and ethnic minorities competed for wages, won the jobs. Employers got away with reducing salaries for all.

It is good to see wealth transferred from the few to the many, but that is not what happened in the period following civil rights and women’s liberation. The total share of earnings was diluted by workers accustomed to less pay, in a system where entry workers cannot negotiate their wage.

The American workforce participation rate declined, most sharply in 2009 when President Obama supposedly saved the economy, and it never recovered. Important to understand when unemployment goes down but the workforce participation rate remains flat, then the percentage of remaining unemployed transfers over to workforce participation rates. Lo and behold it was down 5% from 2007 as President Trump touted the best unemployment rate of all time.

Corporations hired women for decades, improving their wages to the detriment of total household wealth. See this clearly, because it is good that women and non-whites are getting better jobs and pay on a positive trend line since 1970, but it is unfortunate that average wages have flattened over the same curve, thereby reducing household wealth over time, stealing from everybody, installing the two-income paradigm.

I am not even discussing the extraordinary drag on American wages resulting from free trade agreements with China and Mexico. Millions of good paying jobs were exported. The whole phenomenon is complex, but to simplify, we no longer compete only with American laborers and immigrants, we also compete where we cannot even access the labor market.

The few have become less and less a group of white men. The 1% would prefer it that you not see that they are also becoming more diverse than ever, because they know they have an effective narrative at play when the people fight amongst each other for scraps.

All you have to do is look at the Forbes Billionaire List to see who the billionaires actually are. They belong to a special club, and they know one another. It is the billionaire scene. It is far more classist than racist, or sexist. The foundation of identity politics, few understand, is class identity.

I am a white male, but my history shows a combination of factors that are comparable to communities of color. I graduated high school with a D average. I worked hard after that, earning a 3.65 GPA for my Associates Degree at community college. I have never earned, in my best years, the median individual income. I have been fired from several jobs due to personality conflicts. I rarely get called for job interviews for anything paying more than $12 per hour. I have experienced housing insecurity. My Father has a felony on his record, a problem that haunted our household. They cleaned homes and offices for a living for ten years. Half of my public school classmates were non-white in the Mexican immigrant neighborhood I grew up in. I was latchkey, they rarely helped with schoolwork because they usually worked themselves into the night. By Junior High, I did most of the house cleaning. We moved to Arizona to fend off rising costs in California, and because my parents had no risk management skills, because finance is an upper class trait that nobody taught them, and they went bankrupt. Their parents were gambling addicts and alcoholics. I was a first-generation college graduate, again, from community college.

Add to the balance that I was born into the Church of Scientology, making me a weirdo at school. I am permanently traumatized from being identified as the outsider, ever year K-12, because that identity was instilled so early on. My parents bypassed personal responsibilities by funneling me through Scientology coursework, further alienating me from them, from myself, and the average person at once. My entire adult life can be observed as a struggle from one position to the next, never quite fitting in, often feeling dismissed on personal grounds, then emotionally lashing out from it, bringing myself down and burning bridges all the time.

I struggle to find my privilege. I am a highly marginalized individual with a story that doesn’t fit into the logic of identity neoliberalism, just because I am a white male does not mean all the doors have opened for me. Mostly they have slammed shut.

Don’t tag the victim card on me, because this is not the point. The point is, if personality is what gets you passed the job interview, that enables people to be taken seriously in debates, that makes you a social media influencer, a television journalist, then personality is exactly what makes me unprivileged, rather, I am disastrously marginalized. And it demonstrates class privilege above all.

If our world is a cult of personality, then those folks who do not match up will be prevented from sharing their talents and contributing their genius. This is the world I believe we live in. It is driven by a global financial order, not a white one. It infuriates me to see the white liberal class turn the truly marginalized artist class into a mouthpiece for the global elite.

My argument is that personality has become the number one factor for marginalization today. What matters is your orientation to authority. This is why China and the Chinese people are close to knocking the United States off the global pyramid. Again, I am not threatened, because I know the people of China want liberty too. The more educated they become, the more they will demand liberty. That is why Xi Jinping has consolidated power and control using internet technology, in addition to good old brute force. That is why the Occupy Movement was shut down in brute force. That is why we have been quarantined.

As more and more folks are educated, there are personalities that don’t fit the mold who take their genius into manual labor, doing rote work, where they are stuck with their brilliant ideas for which they cannot access capital. If we are lucky, we get to listen to podcasts at work, while yearning to interject that conversation rather than pack boxes for Amazon. We are deeply frustrated. Some folks are inclined to fall into depression and addiction, so lo and behold, we have the opioid epidemic at play. Then the liberal elite solution is just to give them safe injection sites and to selectively enforce trafficking laws while continuing to deprive people of universal health care, the only thing that would actually prevent rampant self-medication.

I suppose the bottom line I am making is that most people now are smart enough to see that the narratives are not adding up, the stories we’re hearing are not real, but we blame and shift our trust into different authorities rather than awaken our powers of discernment. We seek enemies of convenience when we fail to see the common enemy. I know that folks are smart enough to realize when they have been duped, so I worry about that day coming, because I think it is a little bit backed up by now.

We are smart enough to develop arguments and have opinions, but we are not cautious enough to hold off before pointing the finger. We are deliberately placed into this social media industry as willing tools of their profit to become addicted to the fear and anger that it generates in us. This is a clearly understood, documented marketing strategy. It is disgusting.

I believe that someday we will come to realize that we live under the invisible regime of intellectual apartheid. If this is a form of apartheid, where the most intelligent people in the country are told what to think by the media, by the politicians, and by social media influencers, there will not be conformity without resistance. I believe we are watching right now the divide reach unprecedented tension, and it will snap.

With the most educated populace ever, the pressures will continue to mount until our workplaces are democratized, our financial systems are democratized, our scientific discourse is democratized — a whole revolution of liberalization within the American constitution. I believe that our constitution and our system can accommodate extraordinary progress over time. All advancements can be made peacefully.

I don’t know if we need to be led out of this, or if we need to wake up individually. If I am right, we’ll see authoritarianism rise to be challenged and defeated, or completely defeat us.