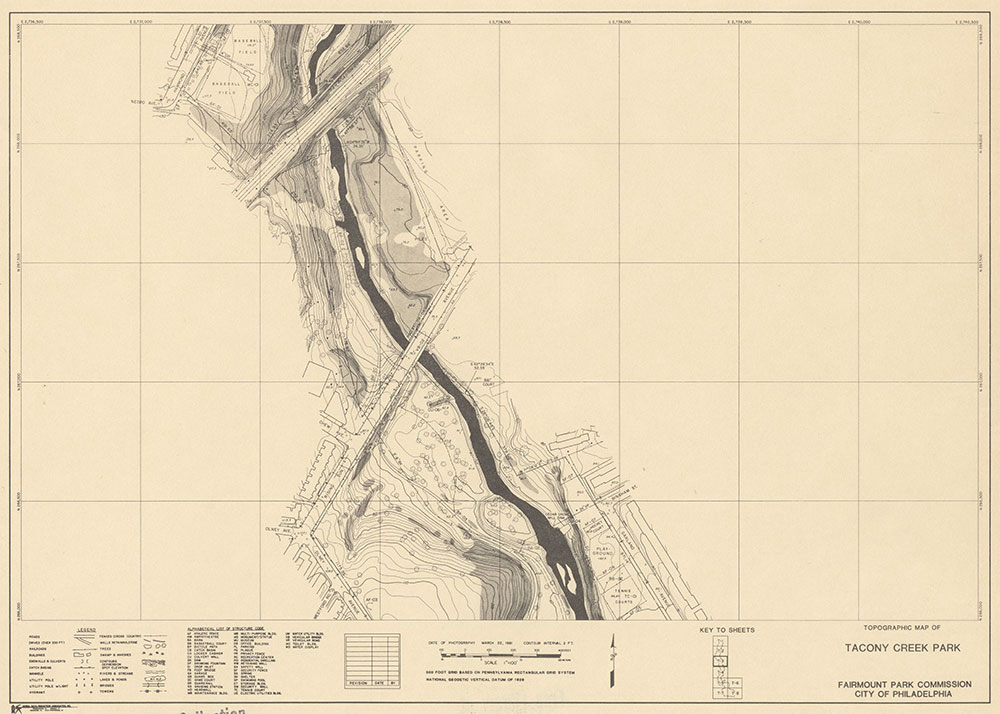

Image of Newberry Road taken on my iPhone, January 2017.

Nobody has an identical story. This applies to every human being and their finances. Even though we share a common system, currency, and world, your story is your own, so you have to start from where you are.

It may be that you were born into a trust fund, or poverty, or somewhere in between. There are hardships for everyone in this life, in this world. You may find yourself wealthy one year and broke the next. Everyone has a different rock bottom. If you never had any money in your life — your parents were broke and you never built a steady career — then you might be in the best position to grow wealth.

I am pretty much talking about myself in that last observation. I will share my story so that you understand how a low-income person can dig out of chronic poverty.

My folks were cleaning service workers in Santa Barbara, California. They built a small business and started poking through to the middle class for the first time in their lives. Neither of them finished college. They both grew up in rural towns of the mid-west. My father’s parents always rented. My mother’s parents bought affordable property. One side gambled, the other side drank.

To cut to the chase, my parents ended up selling the cleaning business, finding middle-class jobs, migrated the family to affordable Tucson, went bankrupt, and dug themselves back out of that, now retired and barely meeting costs.

They were not drunks or gamblers — they lost extra money to other bad habits. They didn’t have enough financial sophistication to manage risk. It was tough on all of us. Look, they did better than their parents, but they instilled a poor understanding of finance. They are not totally to blame, it ought to be a major aspect of public education.

It took until roughly age 35 for me to begin the journey of financial planning. All the years between age 18, when I first moved out of the parents house and began living on my own, I felt good about having $100 leftover at the end paying bills. I slowly ratcheted that up between about age 30 to 35, but I was not holding money, not investing, it would always cross back to zero and I’d have to get on the phone to fight overdraft fees far too often.

There is one valuable discipline I learned in fifteen years of being a poor adult, starving artist rebel character: Austerity. I do not need much. Earning less than a thousand a month for years at a time will teach you how to live on less than a thousand a month. If you have not read Siddhartha by Herman Hesse, do it. You will understand.

When you understand how the poverty mentality forces you to buy things with the only extra money you have, before you have even saved up an emergency fund, then you will cease to do this. You will prioritize much better. Knowing how to be poor is an amazing skill when you’re making yourself rich on a low income.

My credit history comprised mostly of student loans. I had defaulted on them in 2010. I did not understand what had happened. I got my Associate’s Degree, then dropped out of University studies without buttoning up the loans. I was a punk. I thought nothing could touch me. I started changing my habits and attitude at this time, very slowly.

First thing was first, I consolidated my loans in 2011 under the Income-Based Repayment (IBR) program. This is a fair deal — if you can call our regressive student finance system fair at all — because if I do not cross a reasonable figure considered excess income, I do not owe any payment on a monthly basis. If I continuously reapply for the program then all debt will be forgiven after twenty years. So far, in eight years, I have made all my payments on time. What is the payment? Zero dollars per month. There are drawbacks, but we’ll table that.

In 2018, I began making overpayments to my student loans, to ramp up my credit score. The more payments you make, the more months in a row that your debt figure goes down, the more credit points you accrue. Also, you get a tax break for those overpayments. Because they are just paying down interest, you get to deduct that from your tax burden.

January of 2017, I was living on a farm on the northern edge of Portland, Oregon, in discussion about a two-year live-in caretaker position there. I would be able to save money fast, the plan was to sock away capital and move to the east coast where property was cheap. Then, a massive snow storm came in, held ice for two weeks, and collapsed the road in a mudslide on the day of the big melt, literally splitting access between the two halves of the property straddling Newberry Road. The job was cancelled and I was asked to move.

My seasonal job at the soccer stadium was not restarting for months. The snow storm stopped my other travel-based income for two weeks. I had spent extra money over Christmas. I was flat broke. I moved into a basement room with my girlfriend, who was also broke, at her bosses’ house. Our lives were insane.

By the end of the year, we were driving away from Portland with about $15K between us. In a world where people of our income bracket statistically speaking don’t have $400 to cover an emergency, where even fewer can maintain a 4-figure balance in their bank account, I would say we did an incredible job turning our situation around.

I want to look at that year of my life in pinpoint detail, because I believe we could have had $15K each if we were only a bit more adept and considerate of the opportunities in front of us. Nonetheless, we pulled it off. We pulled ahead and neither of us have been down to $100 after bills since.

Through 2018, I learned about how to buy a house and changed my life by moving to Philadelphia. Through 2019, I learned how to properly save money. The lessons I learned last year have serious implications on my failure to grow my savings toward buying a house in 2018.

Anybody with as little savviness as I had then can learn from my mistakes and develop their assets immediately. One of the big boats in that equation might be sailing now: Bitcoin. Right now it is surging and I think by July, BTC will settle at a new resistance point far above the $20K high of 2017.

Having told my story, I want to get into the financial weeds next time I post. I want to show how great our financial opportunities are compared to our parents, even in an economy that is garbage.

Until then, good luck, talk to you later.